Can I Add My Mobile Home To My Home Insurance?

Caeva O'Callaghan | March 4th, 2024

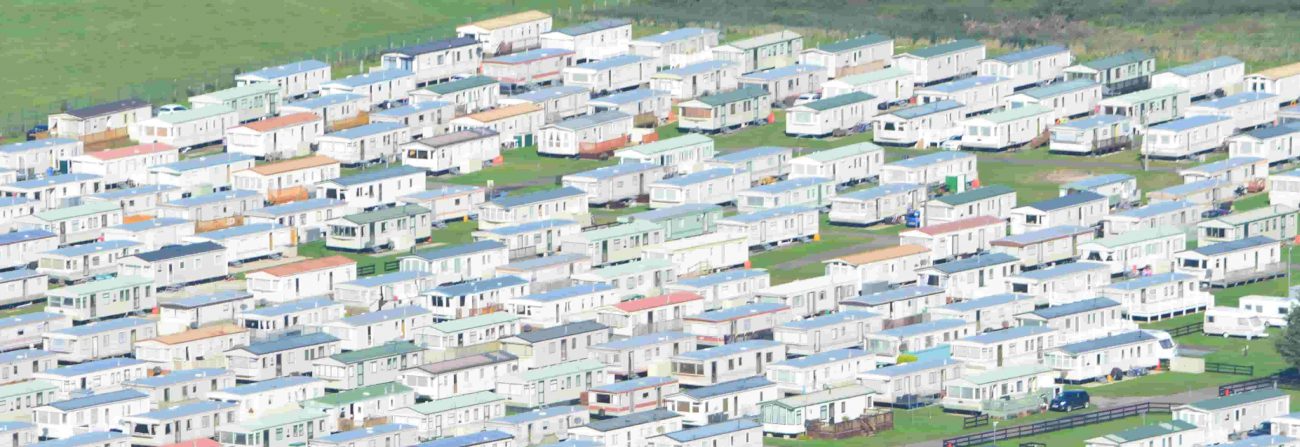

Mobile homes and caravans make a great home from home – but can you cover them under your standard home insurance?

Yes, no problem. You can also insure mobile homes by themselves on a standalone home insurance policy.

Your mobile home will be covered for accidental damage, furnishings and fittings as well as clothing and personal effects, but only in certain circumstances.

In this article, we’ll cover the following questions:

- What does mobile home insurance cover?

- What does mobile home insurance not cover?

- Can I rent out my mobile home under my insurance?

What does mobile home insurance cover?

Mobile home insurance can cover the costs of repairing or replacing your mobile home itself, and the belongings you keep in it, if they’re damaged in a fire, storm or flood or stolen.

In short, mobile home insurance covers pretty much everything your normal home insurance covers.

When a mobile home insurance policy includes structure and contents, you can expect the following to be covered:

- Your mobile home or caravan – its structure and any fixtures or fittings that can’t be removed

- Its contents – furniture, carpets, appliances, etc (but only while parked or temporarily towed)

- Your personal effects – clothing, bags, jewellery, sports equipment, bicycles, etc

Many policies offer new for old cover, which means you get the full replacement cost of items that are lost, stolen or damaged. However, some policies will only offer you the amount that your items are worth at the time of the claim.

Following an insured event, the cost of removing the mobile home to suitable repairers and delivering to the premises is also covered.

What does mobile home insurance not cover?

When you take out a mobile home insurance policy, it doesn’t cover liability while it is attached to any vehicle. This will be picked up by your car or van insurance.

Storm is not always covered by standard mobile home policies, so if you’re particularly worried about storm damage then make sure to ask for it at the quotation stage.

Mobile home insurance will also not cover:

- General wear and tear – it’s up to you to keep your caravan or mobile home in good condition

- Vandalism – check your policy, because some will not cover intentional damage or graffiti

- Theft – if you rent out your mobile home, or if the property has been left unoccupied for more than a certain period of time, your insurance may not be valid

- High-value contents – high-risk items such as laptops and cash may be excluded

- Smoke damage – policies will often exclude any damage caused by smoking inside the mobile home

Can I rent out my mobile home under my insurance?

If you earn an income from leasing out your mobile home, it’s absolutely necessary that you consider public liability insurance. This covers you if a guest accidentally injures themselves while staying in your caravan or mobile home.

Public liability insurance isn’t strictly a legal requirement. But, if you don’t have it, it could cost you hundreds of thousands of euros if a claim is made against you.

If someone is injured, or even dies, while using your mobile home, then you as its owner would most likely be liable. If you don’t have public liability insurance then you will have to pay all associated costs, including legal expenses.

One way to reduce the cost of your premium and ensure the safety of your guests is by increasing the security of your mobile home. Something as small as installing window locks could reduce how much you pay. For bigger savings, keep your mobile home in a secure area with better security measures such as CCTV and a perimeter fence.

When you’re looking for mobile home insurance, think carefully about how you’ll be using your mobile home and what risks you want to be covered, to make sure you’re not paying for insurance you don’t need. You’ll need to do a thorough appraisal to work out the cost of replacing your mobile home and its contents, in case they are damaged beyond repair.

If you have any more questions about mobile home insurance, don’t hesitate to give us a call today. You can contact us Mon-Fri between 8.30am and 5.30pm on 0818 224433 or 042 9359051.