My Roof is Leaking – Will My Home Insurance Cover It?

Caeva O'Callaghan | November 8th, 2023

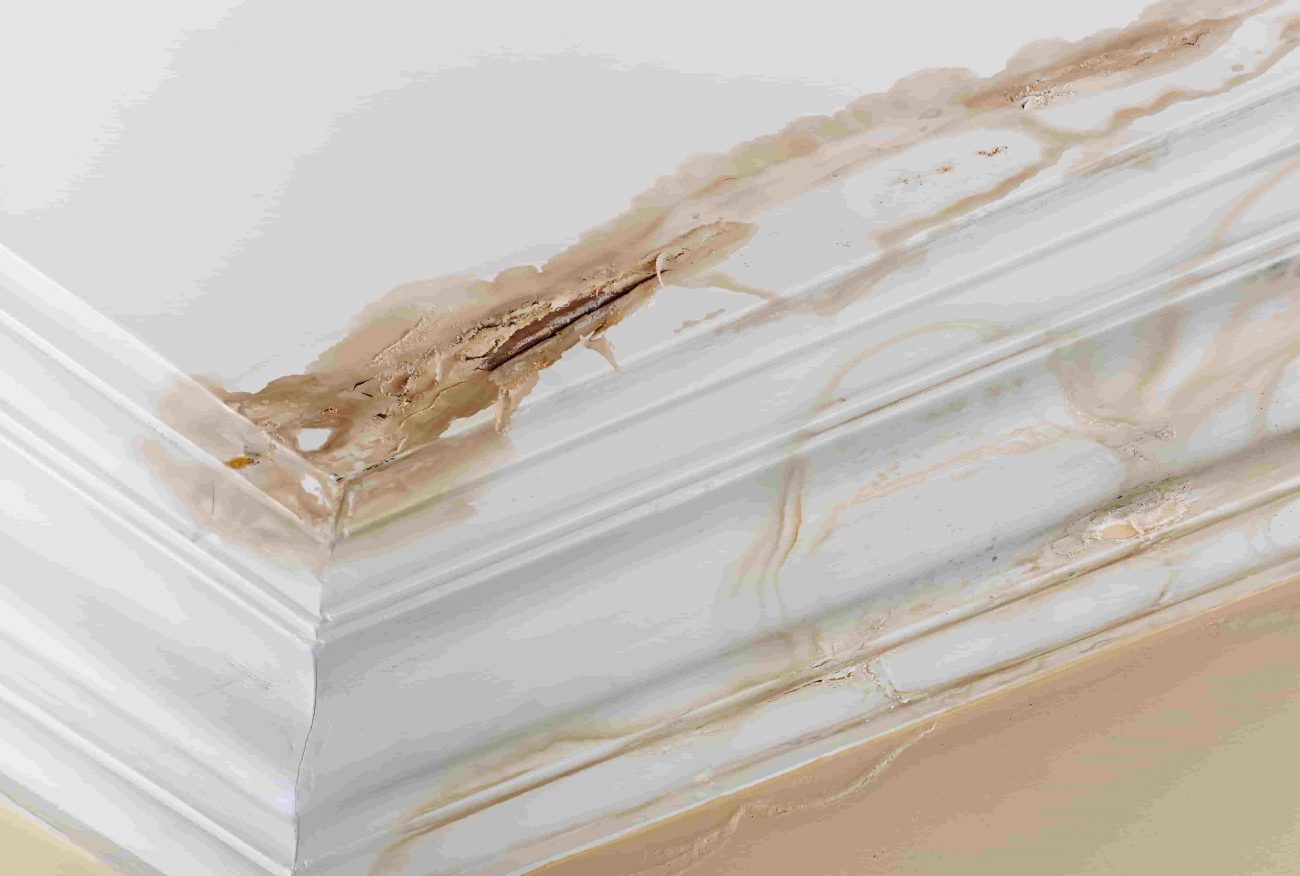

A leak in your roof can do catastrophic damage. But will your home insurance replace your soggy stuff and pay for repairs?

Yes, or no. It all depends on why your roof is leaking. If a storm ripped off some tiles and that’s why your roof is leaking, you’ll be covered. If you damaged your roof through negligence or general wear and tear, you won’t be covered.

In this article, we’ll cover such questions as:

- Does my home insurance cover a leak in my roof?

- What kinds of roof damage does my house insurance cover?

- Will I be covered if a storm damages my roof?

As always, it depends on your individual policy, so it always pays to check the small print. However, some standard guidelines apply when making a claim on your roof.

Roof damage from a storm

In general, if a storm has damaged your roof, you can expect to see signs of damage to the exterior. This means quite a few missing tiles, tree branches, and debris. If that’s the case, you will be covered by your home insurance.

Insurers generally assume storms involve violent winds, along with snow, rain or hail. However, in some cases, you may have hail or snowfall without winds, or strong winds that cause damage all by themselves. Almost any extreme bad weather can damage a property and count as a “storm”.

Lightning damage is comparatively rare in Ireland, but it does happen. Lightning strike can pose three main risks:

- Fire, explosion and burns

- Power surges, damaging electronics such as TV’s and broadband routers

- Shockwaves that can fracture concrete, brick and stone

Chimneys are at obvious risk of lightning strike, but lightning can also blow out plaster walls, shatter glass and crack foundations. If lightning strikes your roof, it may leave gaping holes which your insurer will pay for pending the results of an investigation. Insurers will check Met Eireann data to find out if a storm actually occurred.

Wear and tear and neglect

If there aren’t any obvious signs of damage externally, or just one or two missing tiles, it’s more likely that a part of your roof’s structure has worn out. That means that if there’s a hole in your roof, you’ll have to pay for any repairs.

General wear and tear is not covered under any insurance policy. It’s up to you to maintain your property, and your insurance will not pay out if you do not do so. You won’t be able to make a claim to repair your building’s structure, or replace any possessions that get soggy.

Do you have a flat roof? Bad news. These are not only harder to insure, but they also need more maintenance. A flat roof doesn’t protect your house as much against storms and extreme weather. In the rainy, gusty Irish weather, a flat roof will tend to collect water and debris on its surface, rather than it sliding off.

A flat roof surface is more likely to deteriorate quicker, need regular maintenance and spring a leak. There’s a higher chance of you making a claim on your buildings insurance, which means they’re more expensive to insure. But, if you haven’t kept up with the higher maintenance demands of flat roofs, you might be in for a nasty surprise when your claim is refused.

Bad workmanship

When you get a contractor in to do roof repairs or install new roofing, you need to be absolutely sure they’re doing a good job. If you get a cowboy in, you’ll end up paying for it years down the line.

Insurers consider letting a shoddy contractor loose on your home as a failure on your part to maintain your property to an acceptable standard. So even if you’re happy with the work when it’s completed, failing to check it out properly could cost you dearly when it falls apart.

A poorly constructed roof can lead to movement in the roof joists. This causes the roof to become uneven and shift. A few tiles may slide off, and you might not notice. If water leaks in, you may not be able to make a claim.

Even if the water coming in is the result of the storm, your insurance provider’s investigation may prove it never would have if you maintained your roof properly. If it’s clear your roof had been leaking due to poor maintenance, and not by a one-off event, they won’t pay out.

If your roof is leaking and you need to make a claim, call us and we can help.

If you suspect that your roof has leaked and it is causing damage in your property, call us immediately and talk to our home insurance team. We can advise you on your claims. Our team of home insurance experts have been helping our customers in Ireland for well over 30 years. We are available between 8.30am and 5.30pm each weekday on 0818 224433 or 042 9359051.

If you require a home insurance quote, we compare home insurance in the Irish market from 12 insurance providers to find the right cover needed for you.